Walking around VMX and WVC before COVID struck I was impressed at how many companies on the exhibit hall floor were really in the business of compliance. Whether it’s lab work, vaccinations, wellness exams, prescription diets or pharmaceuticals, we are all in the business of compliance.

I thought of a scenario which I saw 8-10 times each day.

Mrs. Sullivan brings two labrador retrievers in for annual exams. They need routine screening lab work, some immunizations, and physical exams. Depending on what part of the country you live in, her bill is probably going to be between $300-450. Most pet owners can swing that amount once a year so this is not the problem. The problem is that either the veterinarian, the technician or a CSR also has to “pitch” them on heartworm preventative, flea/tick preventative, maybe a special lab test (i.e. tick titers or liver values) or a dental.

Mrs. Sullivan is comfortable paying $300-$450 but the level of care you’re recommending for her dogs would bring her bill to $800. And she knows it. You can see it in her eyes while she is doing the math.

She might say “Yes, let’s do it all” but we all know many clients will not – or can not – spend quite so freely.

More likely, she’ll say something like, “You know what? I think I have heartworm preventative at home. Let me check and, if I don’t have any, I’ll come back and get it.”

Your team is not trained on objection handling so they say “Okay…just give us a call!” and move on to the next appointment in their extremely busy day.

But Mrs. Sullivan walks out and either never checks, or does check and doesn’t call or she calls and gets put on hold and hangs up: there are a lot of friction points in this transaction, especially once she’s left your building. Or maybe Chewy gets a hold of her.

She’s not alone – studies show that when it comes to heartworm prevention compliance specifically, 2 out of 3 dogs leave the practice without a single does of heartworm prevention. Studies also show veterinarians have a real opportunity to improve compliance. But new approaches are needed.

A deeper understanding of what drives pet owners is important for us to convince more pet owners that prevention is an essential part of their pet’s health care regimen – and one of the most common drivers is cost.

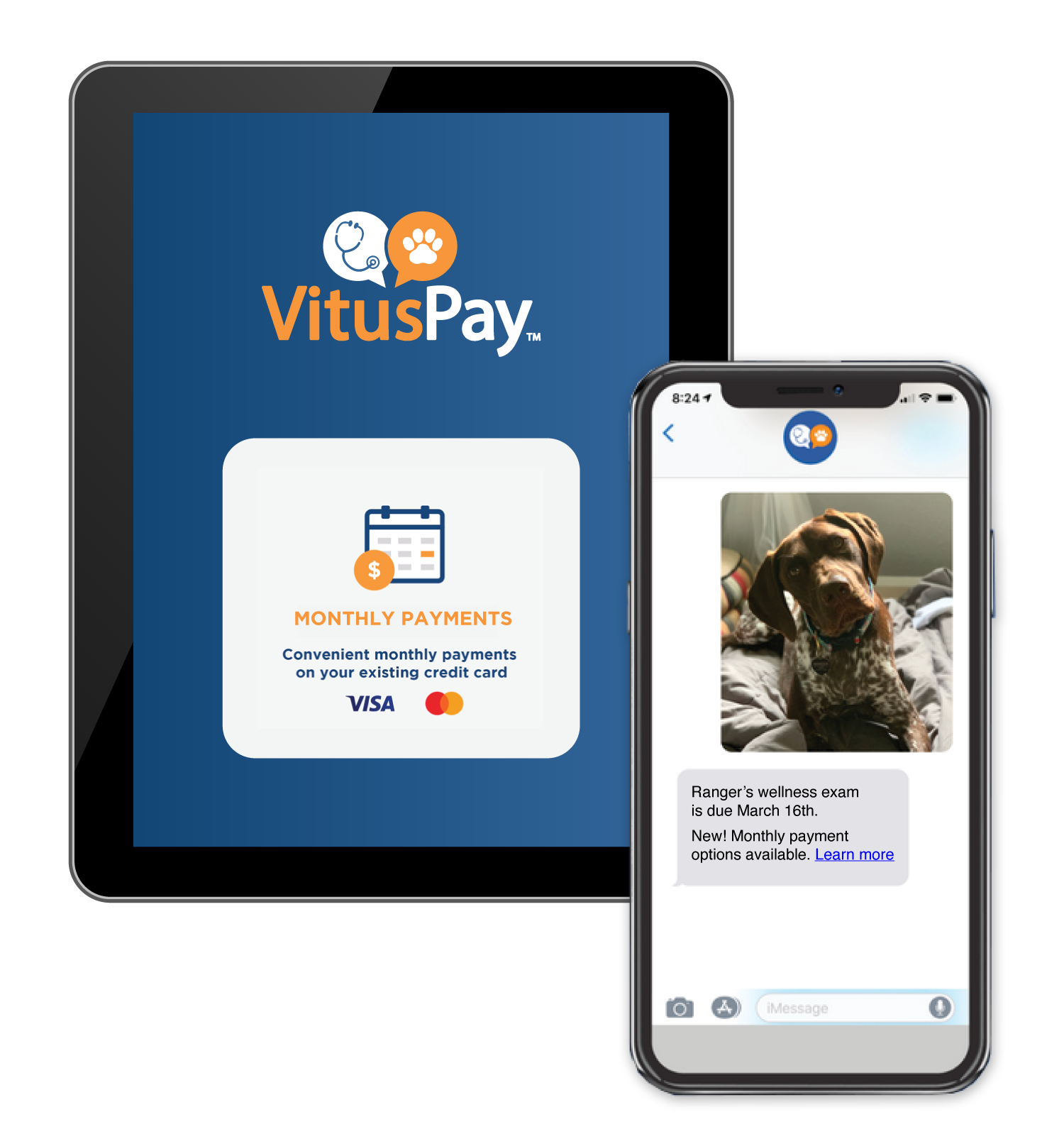

That’s why we created VitusPay.

Our data shows that clients using the monthly payment plans are more compliant – adding preventatives, lab work and more.

Check out a profile of VitusPay user stories to learn more.

Now, re-imagine how the appointment with Mrs. Sullivan would go if your technician could simply add, “And by the way, we have a payment plan where you can pay this off in 6 equal monthly installments of just $133 with no interest.” Is Mrs. Sullivan more likely to follow your recommendations? Our data shows the answer is increasingly, “Yes”.

Why? The plans use a client’s existing credit card so there’s no hassle. No new credit applications. No credit score dings. No interest. No complicated rules about what you can/can’t put on the plan: simple.

The biggest thing in payments right now is “small”.

Why put $800 on a credit card and take 6 months to pay it off, and potentially pay a lot of interest? Given the option, they’ll put $133 per month on their credit card, pay it off every month and avoid interest. This is true for all types of consumers, even the most financially savvy appreciate pay over time options.

Have you recently purchased a Peloton, laptop, furniture or other similarly priced items? If so, I bet they offered you an installment payment plan since 81% of consumers in a recent study said they would use installment payments if they were available, including 63% of millennials who view installments as a helpful option. In that same study, consumers agreed that installment payment plans with no fees or interest are the most ideal – and they are far more likely to choose installment payment options that also build their credit.

You can remove cost as a barrier to care – while also driving higher margin purchases.

by a veterinarian

by a veterinarian