New numbers from the American Veterinary Medical Association show a troubling trend.

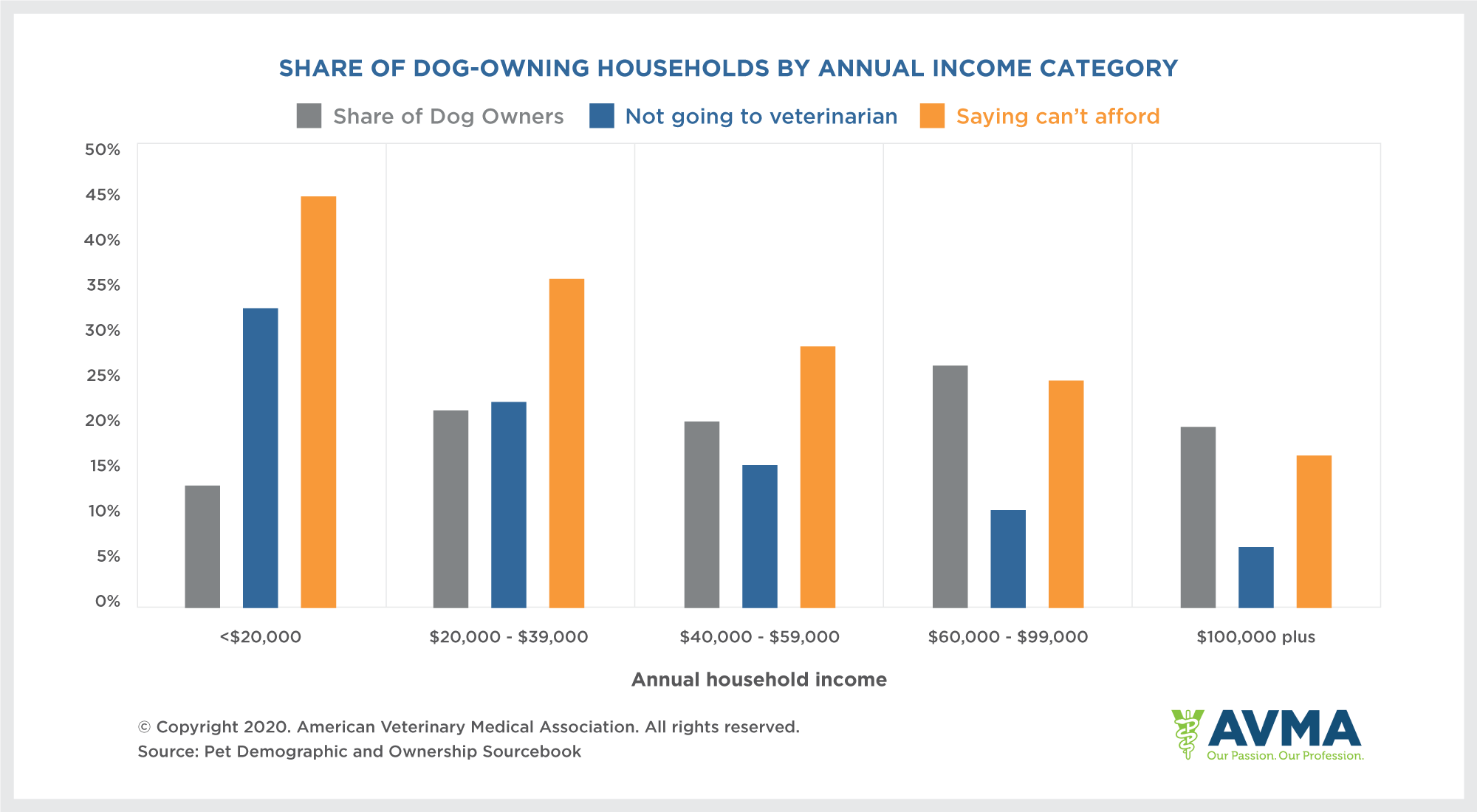

According to this chart, roughly 2/3 of the dog owners in the United States make between $20,000 and $99,000 a year, but approximately 30% of them cannot afford a #veterinary visit. That’s millions and millions of dogs alone in this country. And at a time when shelters and adoption agencies are empty because of people adopting new pets during shelter-in-place rules, and with an enormous number of Americans under extreme financial strain, this does not bode well for the health of our #pets.

These numbers are compounded by another group of owners that say they are uncomfortable visiting their #veterinarian during the pandemic. This resistance to seeking care further impairs their ability to get needed medical support for pets.

And the truth is that the lingering financial effects of the pandemic will likely stay with us much longer than the actual virus. Meaning that affordability concerns will persist for months or years to come, creating potentially lifelong healthcare concerns for pets.

We know that veterinarians are committed to delivering the best possible care. So, as practices think about the challenges of providing that care in the face of social distancing protocols and dire financial circumstances, there are lessons to be learned from one another.

1. Customer Choice in Payment Plans

Many owners want to care for their pets properly but cannot afford it. Helping extend payment terms or offering monthly payment plans is a great way to ensure pets receive needed care while providing owners with financial peace of mind.

Some practices offer in-house #payment plans, while others use third party solutions that make new credit cards or terms available. These point of sale financial solutions are hugely popular, with McKinsey tracking $94 billion in total US consumer purchases in 2018 made through services like Affirm, Klarna, and more – a rate that outpaces traditional unsecured lending.

VitusVet is now rolling out its own VitusPay service that allows pet owners to make equal monthly payments using their existing credit cards. Many pet owners like this option because they do not have to apply for new credit and others want to continue to earn rewards or cash back on their existing credit cards.

The key for practices is to offer clients choices in how they manage their pet care bills, with an emphasis on solutions that are intuitive for pet owners yet simple for staff to implement and manage.

2. “Anywhere Checkout” Eliminates Front Desk Lines

Another advantage of VitusPay is that it comes with mobile tablets and card readers – allowing for checkout from curbside, the exam room, or elsewhere in the practice. In an age of social distancing, this helps avoid queues at the front desk for checkout. We’ve also heard of practices using over-the-phone payments to avoid lines of people within the facility.

3. Lock-In Wellness and Appointments with Forward Booking

If you’re like me, then you’ve been impressed when asked by your dentist to book your next six-month appointment while checking out, or even filled out a postcard reminder to yourself that would arrive in the mail months later.

Why be jealous of your dentist’s smart business strategy – co-opt it for yourself! Asking clients to forward or pre-book their next pet appointment is a smart way to increase compliance and loyalty.

4. Tech for Social Distancing

Leverage technology like two-way texting platforms to enable remote pet care or curbside check-in and return of pets at the practice.

Practices and owners can share texts, photos and suggestions for routine questions without an in-person visit. For those that do come to the practice, owners can remain in their car and away from others with veterinary team members texting when they will see the pet or return it.

We’ve actually seen a dramatic increase in two-way texting by our clients with a more than 152% increase during the outbreak.

5. Ensure Medication Compliance and Refills Using Online Ordering

We’ve also seen pet owners turn to mobile apps like ours to manage online ordering for products and prescription refills. This push to online interactions and ordering is a great way for practices to enforce social distancing while also deepening engagement and loyalty with clients.

6. Pet Insurance for New Adoptees

Many new pet owners might be unfamiliar with pet insurance. For those families that have adopted a new pet during the outbreak, their first practice interaction is a great time to introduce the benefits of pet insurance, which can help mitigate the costs of both emergency and routine care for families concerned about finances.

No matter where your practice is located, the level of stay-at-home rules in effect, or the affluence of your customers, the truth is that you have to meet your customers where they live in this moment. Turning to technology can help you manage short term needs around social distancing and affordability while also future-proofing your practice against competitors and inevitable disruptions.

by a veterinarian

by a veterinarian